Summary

Businesses are now able to apply a tax code to a sale type and have the POS use this to override the tax code applied to individual PLUs.

This new functionality will allow hospitality businesses in the UK to accurately calculate and apply VAT to their food orders depending on whether the food is ordered for eat-in or takeaway, saving time and money and ensuring compliance with VAT regulations.

The overview article on Tax Code Per Sale Type is here. This article also details the specific use cases for this functionality.

Configuration Required

To ensure that your POS accurately calculates and reports tax on the items you sell according to the governing legislative requirements, you will need to consider the following configuration.

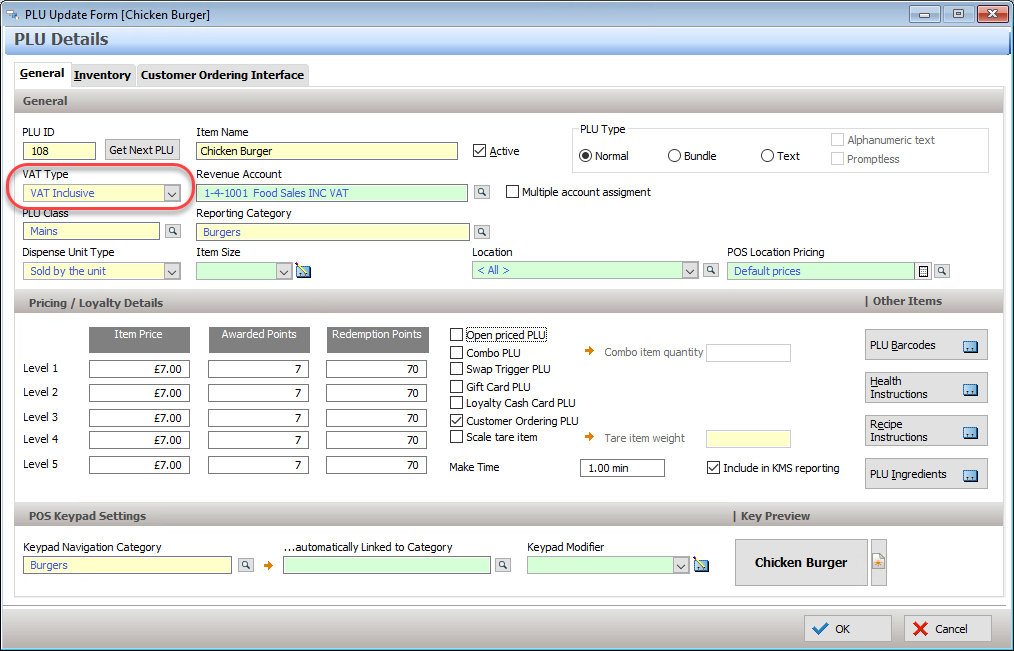

Assign the correct tax code to the PLUs

Each PLU should be programmed with the most appropriate tax code. For example, if you are going to assign the tax code 'VAT Inclusive' to the Dine In sale type you should program the PLU with the tax code applicable to the item if it is sold as a Takeaway item.

If a sale does not have a tax code applied to the sale type, the tax code programmed on the PLU will apply.

You can learn more about programming PLUs and assigning the tax code here.

Assign a tax code to the Sale Type

If you need the system to apply a specific tax code to all the items in a sale based on whether the customer will consume the items on-premise or off-premise, you can assign the tax code to the relevant Sale Type.

You can learn more about programming Sale Types and assigning the tax code here.

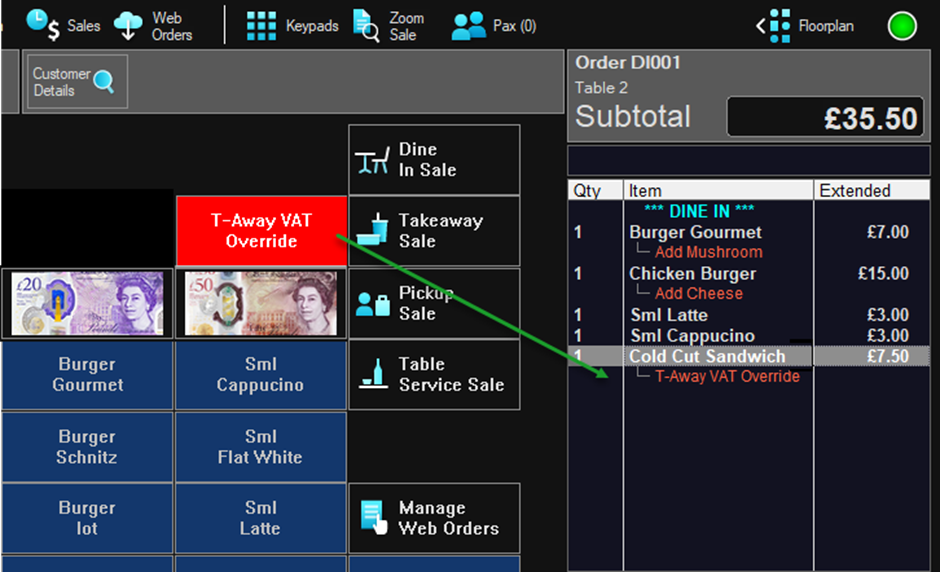

Program a Tax Override button on your POS keypad

There may be times when you need to comply with a mix of regulatory requirements.

For example, in the UK all Dine In orders are VAT Inclusive, while the items in a Takeaway order can be either VAT Inclusive or VAT Free depending on the specific item. If a customer places a Dine In order and then includes an item to be packaged for taken with them, you need to be able to change the tax status for that takeaway item.

To facilitate this you will need a Tax Override button programmed on your POS keypad.

You will use it like this:

- Open a Dine In sale

- Enter all the required items, including any that the customer will take out with them.

- Highlight the take out item and use the Tax Override button (labelled in the example as T-Away VAT Override). Repeat for all take out items in the sale.

- The override will be listed as an instruction for the item so that it is clear which items have the override applied.

You can learn more about programming buttons for your Product Keypads here.

You will need to select an Other button and choose the key type GST Free Override.

Reporting

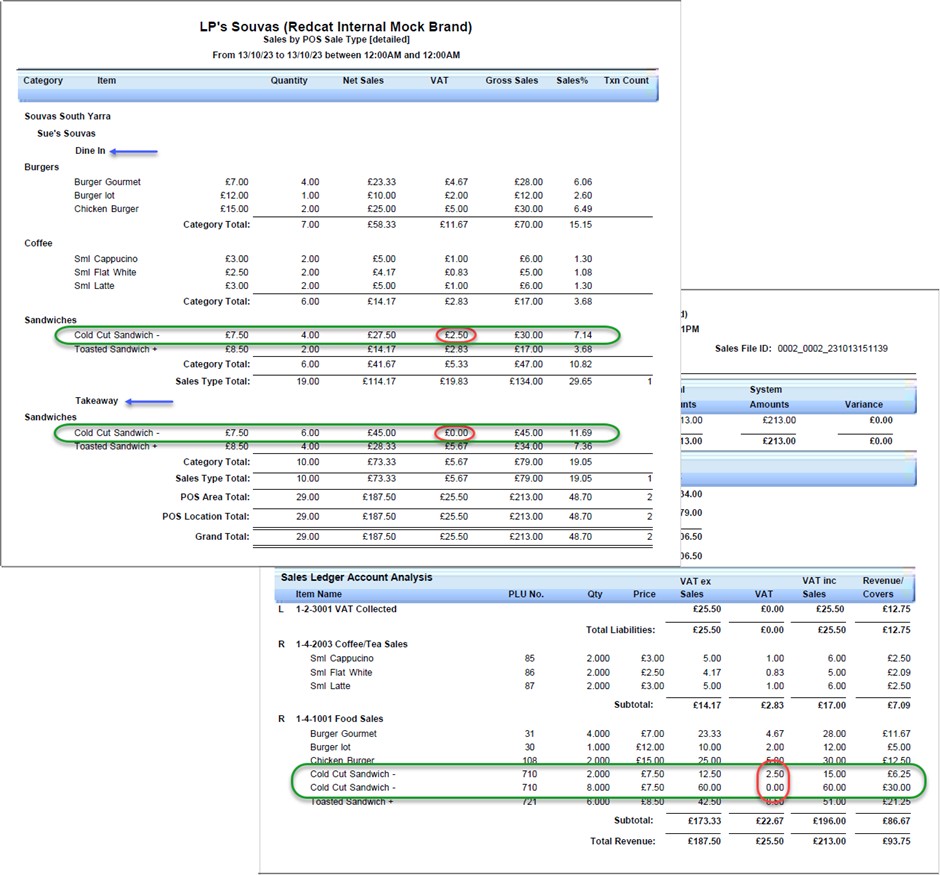

The tax status for each individual PLU as it is sold is saved, and reports will separate instances of instances of items with tax from those without tax.

You can see this in the sample reports below.

Article Change Log

| Date | Record of Changes | Author |

|

October 2023 |

First publication of this article. |

Susan B |